Geopolitical developments: Ukraine-Russia talks

On June 2, 2025, Ukraine and Russia held a second round of peace talks in Istanbul. While both parties agreed to exchange approximately 6,000 deceased soldiers and wounded prisoners, they made no significant progress toward a ceasefire. Russia proposed a ceasefire contingent upon Ukraine withdrawing from four occupied regions, a condition Kyiv is considering. Additionally, Ukraine presented a list of 339 children allegedly abducted by Russia, demanding their return. Russia agreed to work on returning only ten. The talks were brief, lasting under two hours, and concluded without a ceasefire agreement

European Central Bank (ECB) meeting

The ECB is scheduled to hold a monetary policy meeting on June 5, 2025. Market expectations suggest a 25 basis point cut in the deposit rate, bringing it down to 2.00%. This anticipated cut would mark the eighth consecutive reduction since June 2024. The decision comes amid easing inflation and weak economic growth in the eurozone. However, ECB officials have indicated limited room for further rate cuts and emphasized the need for flexibility in monetary policy decisions.

Market drivers – June 03, 2025

With a mix of geopolitical tension, monetary policy shifts, and technical cycle projections aligning, traders and investors are closely watching for directional cues. June 03, 2025 is also marked as a potential timing pivot, where clustered cyclical patterns suggest a possible short-term top or bottom in key markets—making today’s price action especially significant.

Gold and Silver

- Gold: Prices rose by 1% on June 2, 2025, opening at $3,323.00 per ounce, driven by escalating trade tensions and geopolitical uncertainties.

- Silver: Demand increased, particularly among hedge funds, focusing on precious metals amid market volatility.

Oil

- Crude Oil: Prices climbed nearly 3% on June 2, 2025, due to supply concerns as OPEC+ decided not to accelerate output hikes and wildfires in Canada’s oil-producing regions disrupted production.

US500 futures (ES Mini)

- ES Mini: Futures experienced volatility influenced by geopolitical tensions and anticipation of the upcoming ECB meeting. Investors are closely monitoring developments for potential market impacts.

Euro

- EUR/USD: The euro’s performance is being shaped by expectations of the ECB’s rate decision and ongoing trade tensions. Investors are awaiting further clarity from the ECB’s upcoming meeting.

Fund flows and market sentiment

- US equity funds: Experienced outflows for the fourth consecutive week through May 7, 2025, totaling $16.22 billion. This trend reflects investor caution amid uncertainties around trade tariffs and anticipation of U.S.-China trade tal

- Private equity: No buyout fund raised over $5 billion in Q1 2025, indicating a significant slowdown in the sector. Liquidity concerns and delayed exits have made investors more cautious, leading to a mismatch between capital demand and availability.

- Hedge funds: Increased stock buying at the fastest pace since November 2024, with a focus on technology stocks, especially those related to artificial intelligence. Notable buying activity in North America and Europe suggests a bullish outlook in these regions.

Market rankings – June 2025

Top markets for buying

- Gold: Strong increase in net long positions indicates heightened investor interest.

- Silver: Growing bullish sentiment supported by both industrial demand and investment appeal.

- EUR/USD: Speculative traders are optimistic ahead of the ECB meeting.

Top markets for selling

- Crude Oil: Without specific data, but potential caution due to market uncertainties.

- E-mini S&P 500: Despite a reduction in net shorts, overall positioning remains bearish.

- GBP/USD: Data not specified, but any significant net short positions would suggest a bearish outlook

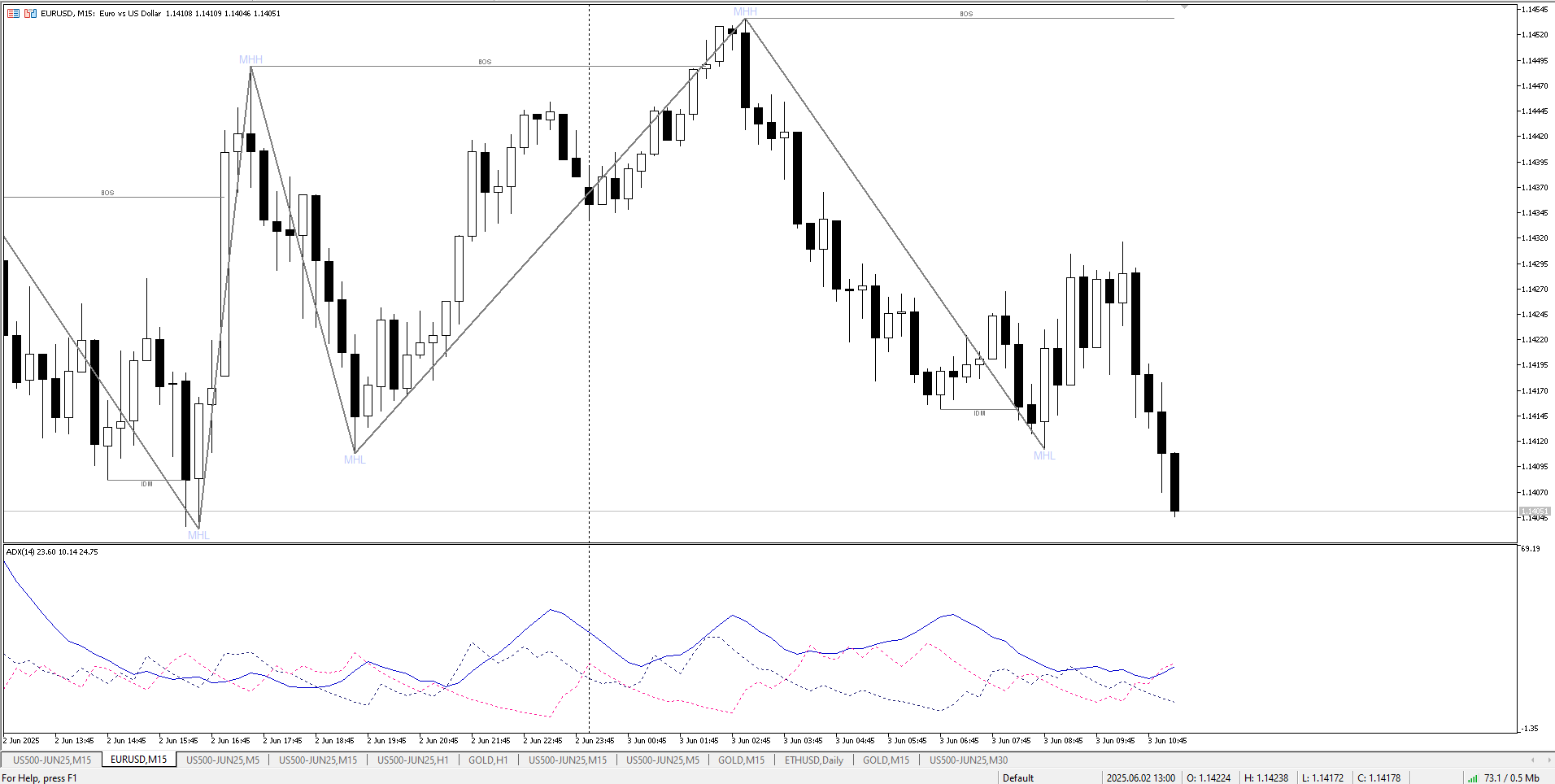

EUR/USD – 1.1435

Displacement candle

- Bullish displacement candle broke 1.1370–1.1400 = clear intent by smart money.

Inducement

- Previous highs near 1.1440 induced retail longs.

- Creates liquidity pool for MM to reverse.

Fundamental driver

- Weak USD due to expected Fed pause in rate hikes.

- Eurozone inflation stable – creating bid for EUR.

Musical vibration

- Current price 1.1435 aligns with “Mi” (E) vibration in the 7-tone scale:

-

- Mi = Momentum stage, often before climax (Fa)

- Suggests rally is at critical liquidity climax.

Imbalance

- FVG gap from 1.1385–1.1400 → expected rebalance (down).

Strategy

- Expect Judas Swing above 1.1460 → sell into reversion to 1.1385 (FVG fill + “Fa” tone = pivot area). And Buy near 1.1305/1.1315 [email protected]

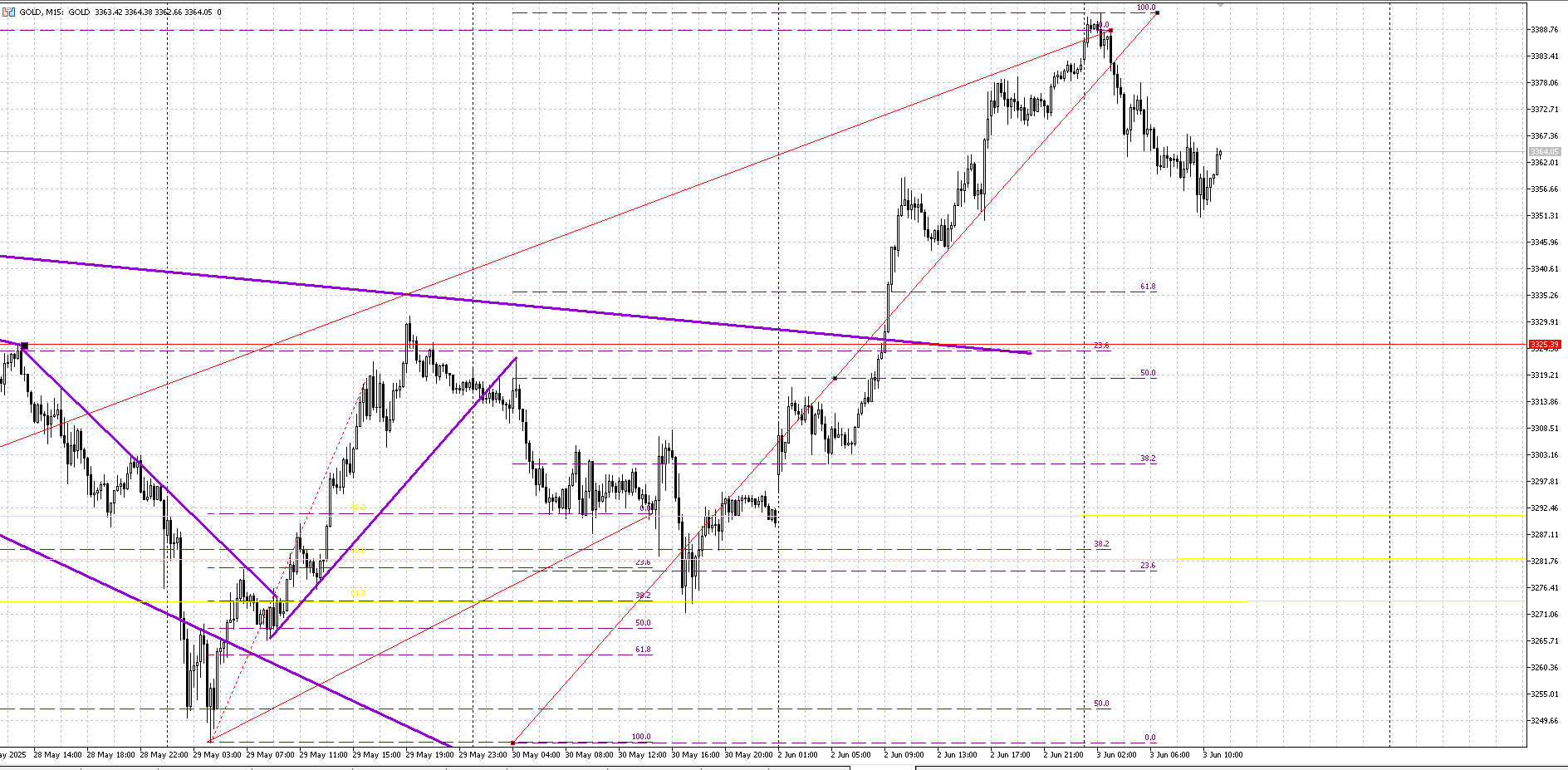

Gold – 3363

Displacement Candle

- Huge bullish candle from 3330 to 3368 on Friday = institutional footprint.

Inducement

- Liquidity resting above 3388 – 3395 = trap for late longs.

Fundamental driver

- Global tension, Fed policy uncertainty → safe haven demand.

- However, real yields stable → short-term correction expected.

Musical vibration

- 3378 is in “So” (G) range:

-

- This is the “Exhaustion” or decision tone before price shifts.

Imbalance

- Bullish imbalance below at 3320 – 3330.

- Price needs to rebalance that gap before another rally.

Strategy

- Sell near 3395 = entry around “La” (A) vibration → anticipate “Ti–Do” drop to 3328-ish zone with Jupiter balance

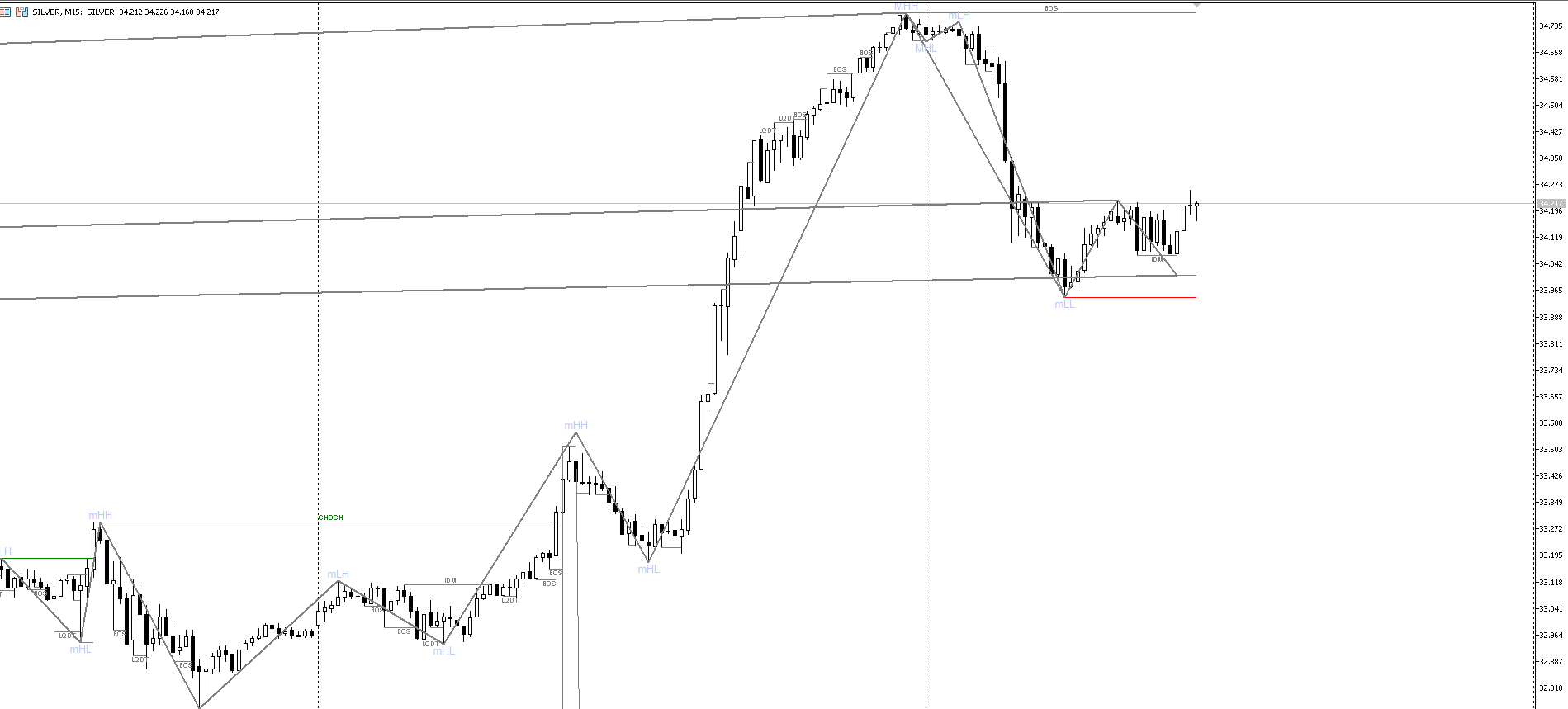

Silver – 3425

Displacement candle

- Daily candle broke through 34.10 → showed strength but likely over-extended.

Inducement

- 34.65–34.80 zone = stop pool from prior highs.

Fundamental driver

- Industrial demand + speculative buying.

- Overbought with weakening macro backdrop (ISM falling).

Musical vibration

- 34.55 aligns with “Fa” → critical inflection tone.

-

- Fa = transition zone → either push to So (34.88) or fall back to Re (34.00)

Imbalance

- FVG at 33.35–33.45 not filled → strong magnet below wait to go long and [email protected]

Strategy

- Expect inducement above 34.70 → sell for mean reversion.

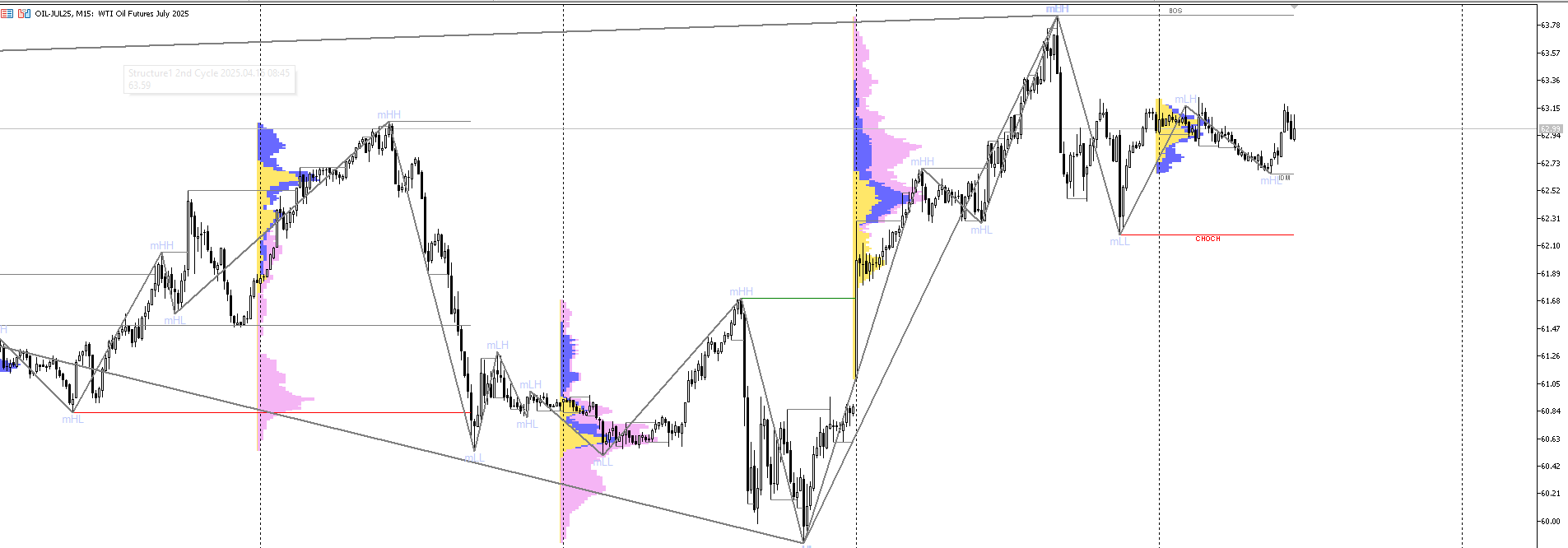

Oil – $63.33

Displacement candle

- Heavy bearish candle last week = trapped longs.

Inducement

- Stops cleared below $64 = early sign of accumulation.

Fundamental driver

- Oversupply fears + weak demand in China.

- But OPEC+ meeting expectations can cause snap-back rally.

Musical vibration

- $63.33 aligns near “Re” (D):

-

- Re = Recovery tone → post-drop accumulation.

- Fits well with PO3 accumulation phase.

Imbalance

- Massive imbalance above from $65.40 – $66.20 → probable target after rally starts.

Strategy

- Buy on confirmation from $62.27/62.42 zone → TP at imbalance.

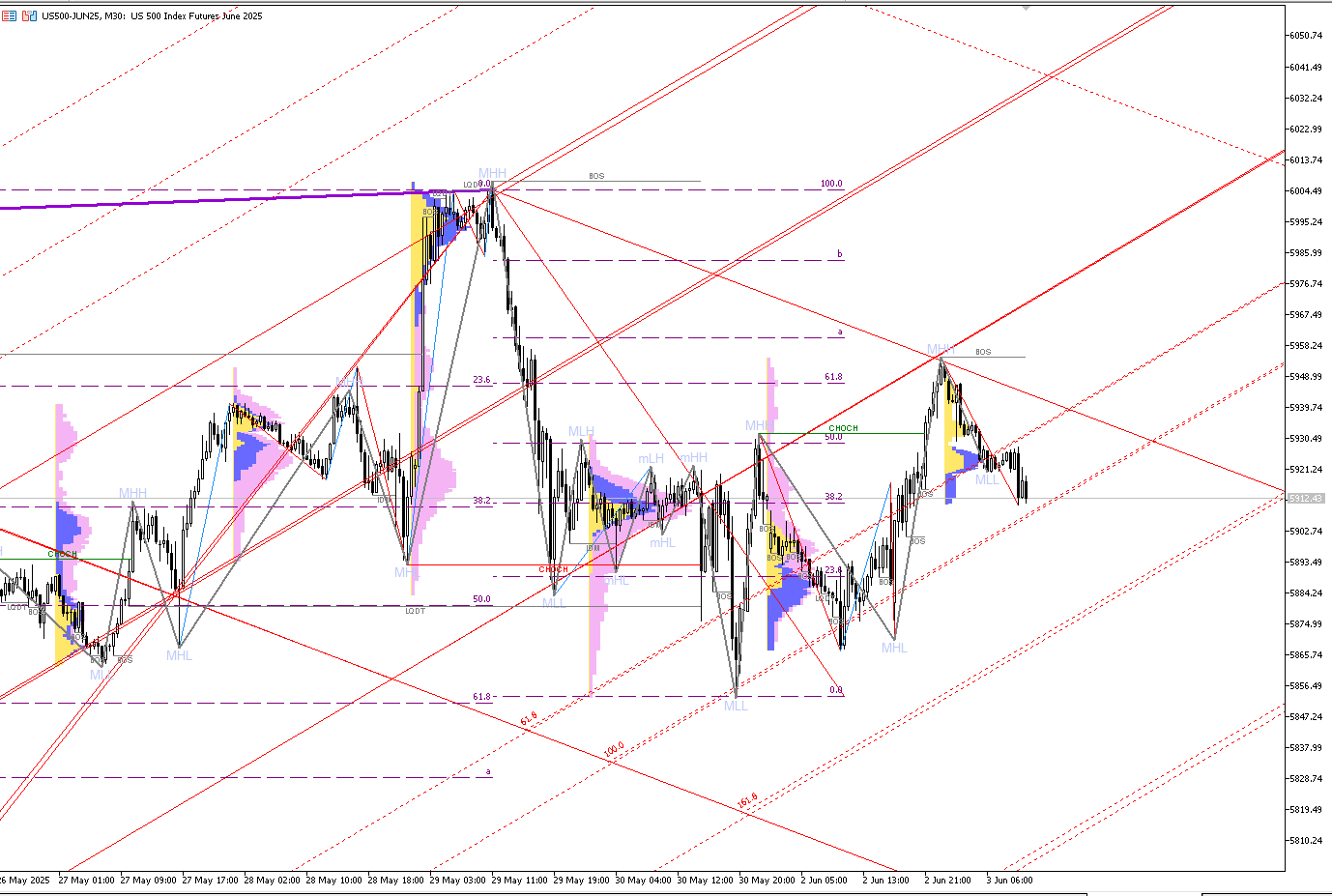

ES Mini – 5917

Displacement candle

- Monster bullish displacement above 5900 = inter day new high breakout towards 5973 possible projections.

Inducement

- 5955-5973 = liquidity trap for late breakout buyers.

Fundamental driver

- AI-driven optimism + strong earnings + Fed rate pause.

Musical vibration

- 5917 = “Ti” (B) tone = overextension stage.

- Often precedes “Do” reset → cyclical reversal.

Imbalance

- Unfilled gap at 5850–5865 on H1 → likely short-term drop.

Strategy:

- Sell near 5973+ for reversal → Target 5917 ( as Mars Saturn mid point around that Area ).

As uncertainty looms across geopolitical and economic fronts, market participants face a critical juncture. Whether it’s the fragile progress in Ukraine-Russia diplomacy, the ECB’s cautious policy stance, or the technical signals converging on June 3, one thing is clear—flexibility, vigilance, and timely decision-making will be essential in navigating the days ahead.